Answer Writing Practice - Day 13 - CS Executive Session 1

Today's questions

Company law (CHAPTER 1)

Q1. Dividend received from a company is exempt from tax in the hands of shareholders. Comment

Q2. Members of a company incorporated under the Companies Act, 2013 are the agents of the company. Therefore, the company can be held liable for their acts. Comment

JIGL (IPC)

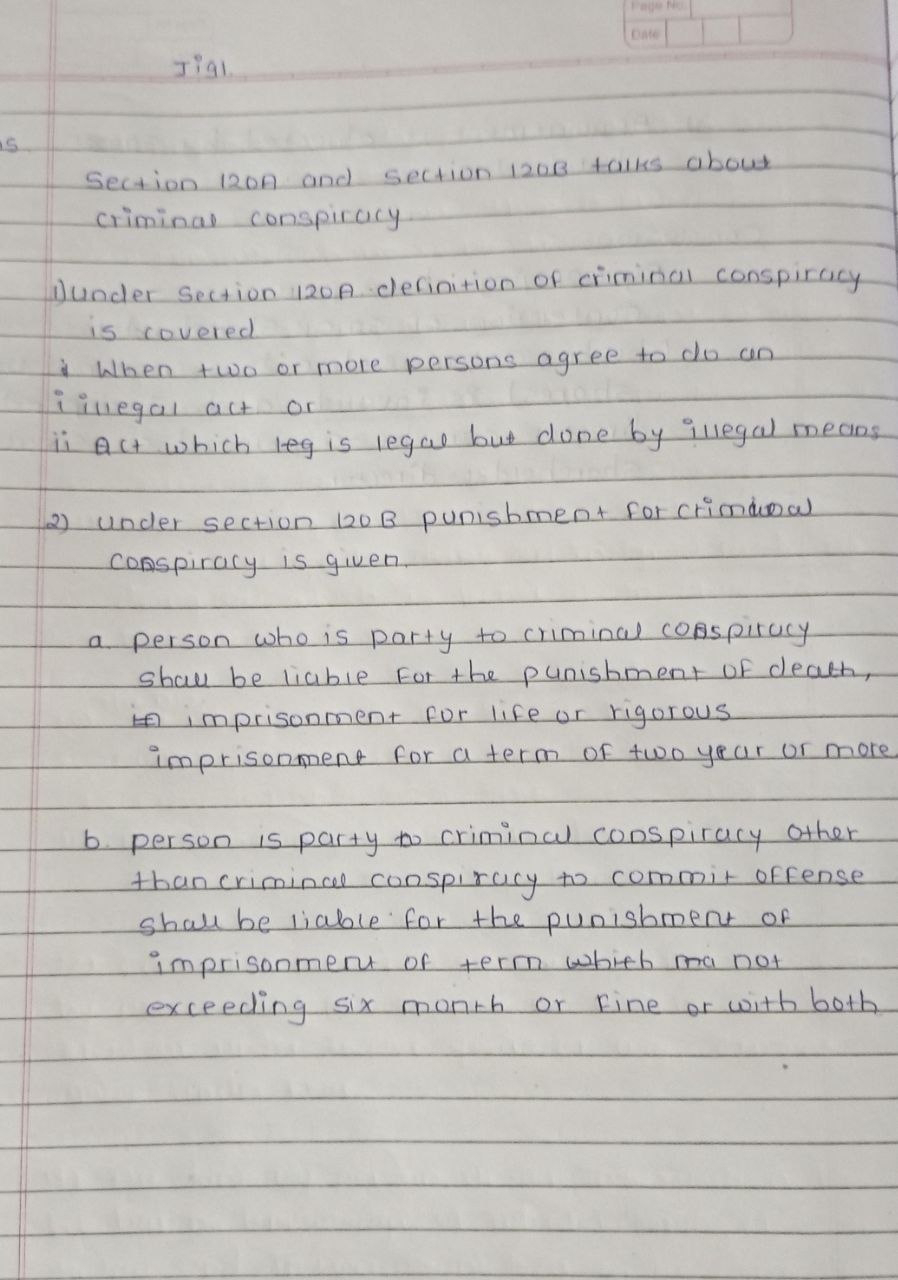

Q1. What does section 120 A & 120 B of IPC says.

Q2. Write any 15 general exceptions.

ONE EXTRA QUESTION (jigl)

Brief about Lodging of caveat.

ANSWERS

C-LAW

A1. Dividend income is taxable in the hands of sh holder after 1/4/20

A2. Company can't be held liable,

Sh holders are not agent of company.

Jigl

A1. General exceptions (simple)

A2. Criminal conspiracy and it's penalties (120a & 120b)

Logging of caveat

In short A Caveat is a caution or warning given by a person to the Court not to take any action or grant relief to the other side without giving notice to the caveator and without affording oppurtunity of hearing him.

It's Validity-90 days

Comments

Post a Comment